碧波摇篮|BiYiClub|抖音:BiYiClub|公众号:BiYiClub|点我加入交流社群学习

本文版权归 2025 Binance 经许可使用|作者:Binance|转载

什么是期权交易?

中阶

要点

Options trading offers traders and investors the choice, but not the obligation, to buy or sell assets like cryptocurrencies and stocks at a fixed price.

期权交易为交易者和投资者提供了以固定价格购买或出售加密货币和股票等资产的选择,但不是义务。

In options trading, most trading activity and profits come from buying and selling options contracts rather than exercising them to trade the underlying asset.

在期权交易中,大多数交易活动和利润来自买卖期权合约,而不是行使它们来交易标的资产。

American options can be exercised at any point before they expire, whereas European options can only be exercised on their expiration or exercise date.

美式期权可以在到期前的任何时间行使,而欧式期权只能在到期或行使日期行使。

Understanding calls, puts, premiums, expiration dates, and strike prices is key to making informed decisions in options trading.

了解看涨期权、看跌期权、权利金、到期日和行使价是在期权交易中做出明智决策的关键。

介绍

Options trading gives you the choice to buy or sell an underlying asset at a fixed price by a specific date. The term choice is essential here because what makes options trading unique is that you are not obligated to buy or sell that asset. You simply have the right to do so if you wish.

期权交易让您可以选择在特定日期之前以固定价格购买或出售标的资产。 术语选择在这里是必不可少的,因为期权交易的独特之处在于您没有义务购买或出售该资产。如果您愿意,您只是有权这样做。

To make this clearer, let's imagine reading a choose-your-own-adventure book. At a point, you might reach a fork in the story, and you must make an important decision: Choose option A or B. Rather than choosing immediately, place a bookmark on the page. You then read ahead, see how the story unfolds, and return later to make the call.

为了更清楚地说明这一点,让我们想象一下阅读一本选择你自己的冒险书。在某个时刻,您可能会到达故事中的一个分叉,您必须做出一个重要的决定:选择选项 A 或 B。不要立即选择,而是在页面上放置一个书签。然后,您提前阅读,了解故事如何展开,稍后再回来做出决定。

This is similar to the concept behind options trading. Traders do not have to buy or sell an asset immediately. Instead, they can purchase an option, which you can think of as a financial bookmark, giving them the right, but not the obligation, to buy or sell the asset later before the expiration date. To do this, they have to pay a premium, which you can think of as the cost of the bookmark.

这类似于期权交易背后的概念。交易者不必立即购买或出售资产 。相反,他们可以购买期权,您可以将其视为财务书签,赋予他们权利,但没有义务,在到期日之前购买或出售资产。为此,他们必须支付额外费用,您可以将其视为书签的成本。

Just as you might sell your bookmark to another reader, you can also sell your option contract to another trader before the expiration date. This allows you to potentially profit from changes in the options value, without buying or selling the underlying asset.

就像您可以将书签出售给其他读者一样,您也可以在到期日之前将您的期权合约出售给其他交易者。这使您可能从期权价值的变化中获利,而无需购买或出售标的资产。

Like those choose-your-own-adventure books with unexpected twists, options trading involves risk. So, it is important to understand how options contracts work before starting.

就像那些带有意想不到的转折的自选冒险书籍一样,期权交易也涉及风险。因此,在开始之前了解期权合约的运作方式非常重要。

什么是期权交易?

Options trading is the act of buying and selling options contracts. To really grasp how it works in practice, let's explore its key building blocks:

期权交易是买卖期权合约的行为 。要真正掌握它在实践中的工作原理,让我们探索一下它的关键构建块:

什么是期权?

Options are contracts that give you the right, but not the obligation, to buy or sell an asset at a fixed price, the strike price, on or before a specified date, the expiration date.

期权是赋予您在指定日期( 到期日 )或之前以固定价格( 执行价格 ) 购买或出售资产的权利(但不是义务 )的合约 。

Imagine you’re interested in a home but not committed to buying it yet. Instead, you negotiate an option with the seller, giving you the right to buy the home at an agreed-upon price within a specified timeframe. You must pay a small holding fee, the premium, to gain this right.

想象一下,您对房屋感兴趣,但尚未承诺购买。相反,您与卖方协商选择权,让您有权在指定时间范围内以商定的价格购买房屋。您必须支付少量持有费,即溢价 ,才能获得此权利。

If the home's market value rises, you can exercise your contract to buy the home at the lower, agreed-upon price. If the market value falls, you can simply decide to walk away, losing only the holding fee.

如果房屋的市场价值上涨,您可以行使合同,以较低的商定价格购买房屋。如果市场价值下跌,您可以简单地决定走开,只损失持有费。

While the strike price may be fixed, the value of the option itself is not. It can fluctuate based on factors like the home’s market price, time remaining until expiration, and market demand. If the home’s market price has risen, the value of your option could increase, allowing you to sell it for a profit without buying the home.

虽然执行价格可能是固定的,但期权本身的价值却不是固定的。它可能会根据房屋的市场价格、距离到期的剩余时间和市场需求等因素而波动。如果房屋的市场价格上涨,您的期权价值可能会增加,让您无需购买房屋即可出售以获取利润。

什么是看涨期权?

A call option gives you the right to buy an underlying asset at the strike price on or before the expiration date.

看涨期权赋予您在到期日或之前以执行价格购买标的资产的权利。

The more the market value for the asset increases, the more profit you make. Thus, you might buy a call option if you think the price of a particular asset will go up. If it does, you can exercise the option to buy the asset at the strike price and sell it at the higher market price, making you a profit.

资产的市场价值增加得越多,您获得的利润就越多。因此,如果您认为特定资产的价格会上涨,您可以购买看涨期权。如果是这样,您可以行使选择权,以执行价格购买资产并以更高的市场价格出售,从而获利。

If the call option's value increases before expiration, you can also sell it, allowing you to profit without exercising it. In this way, you are trading the contract itself and not the asset.

如果看涨期权的价值在到期前增加,您也可以卖出它,让您在不行使它的情况下获利。通过这种方式,您交易的是合约本身,而不是资产。

什么是看跌期权?

A put option gives you the right to sell an underlying asset at the strike price on or before the expiration date.

看跌期权赋予您在到期日或之前以执行价格出售标的资产的权利。

You might want to buy a put option if you believe the market price for an asset will go down. If the price does fall below the strike price, you can exercise the option to sell your asset at the higher strike price. The more the price falls, the more profit you could make. This would also allow you to buy back the asset at a lower market price.

如果您认为资产的市场价格会下跌, 您可能想购买看跌期权 。如果价格确实低于行使价,您可以行使期权,以更高的行使价出售您的资产。价格下跌得越多,您可以获得的利润就越多。这也将允许您以较低的市场价格回购资产。

Like call options, put options can be sold before expiration if their value increases. This allows you to make a profit without exercising them. This is how both call and put options are most typically traded.

与看涨期权一样,如果看跌期权的价值增加,则可以在到期前出售。这使您可以在不行使它们的情况下获利。这就是看涨期权和看跌期权最常见的交易方式。

Underlying assets

We have discussed underlying assets and how options are contracts that give you the right to buy or sell them without being obligated to do so. In our analogy, the underlying asset is a home. But in financial markets, these assets typically include:

我们已经讨论了标的资产以及期权如何成为赋予您购买或出售它们的权利而没有义务的合约。在我们的类比中, 标的资产是房屋。但在金融市场中,这些资产通常包括:

Cryptocurrencies: You can buy options on crypto like bitcoin (BTC), ether (ETH), BNB, and Tether (USDT).

- 加密货币: 您可以购买比特币 (BTC)、 以太币 (ETH)、BNB 和 Tether (USDT) 等加密货币期权 。

Stocks: You can buy options on company stocks like Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN).

- 股票: 您可以购买 Apple (AAPL)、Microsoft (MSFT) 和 Amazon (AMZN) 等公司股票的期权。

Indexes: You can buy options on stock market indexes like S&P 500 and Nasdaq 100.

- 指数: 您可以购买标准普尔 500 和纳斯达克 100 等股票市场指数的期权。

Commodities: You can buy options on gold, oil, and other commodities.

- 商品: 您可以购买黄金、石油和其他商品的期权。

Trading before expiration

到期前交易

It is important to note that waiting until expiration to see a return on investment is not necessary. It is the options contracts themselves that are actively traded.

请务必注意,没有必要等到到期才能看到投资回报。交易活跃的是期权合约本身。

The value of an options contract changes constantly depending on factors like market conditions and time until expiration. This means there is the potential to buy an options contract and then sell it later for a profit or loss. The majority of options trades happen in this way, where you are not necessarily trading the asset itself but trading the right to buy or sell the asset.

期权合约的价值根据市场状况和到期时间等因素不断变化。这意味着有可能购买期权合约,然后在以后卖出以获取利润或亏损。大多数期权交易都是以这种方式进行的,您不一定交易资产本身,而是交易购买或出售资产的权利。

Options Contracts 期权合约

Now that we are familiar with options trading, let's examine the components of the actual options contract.

现在我们已经熟悉了期权交易,让我们来看看实际期权合约的组成部分。

Expiration date 有效期

The expiration date is a specific date on which the option contract will expire. Once this date passes, the option contract will no longer be valid and cannot be exercised. Options can have different expiration dates, ranging from weeks to years.

到期日是期权合约到期的具体日期。一旦此日期过后,期权合约将不再有效且无法行使。期权可以有不同的到期日,从几周到几年不等。

In the analogy where we discussed your interest in a home, imagine you bought an option for one month from the purchase date. This means you would have a month-long timeframe to decide whether you want to use your right to buy the home at the strike price.

在我们讨论您对房屋的兴趣的类比中,假设您购买了自购买之日起一个月的期权。这意味着您将有一个月的时间来决定是否要使用您的权利以执行价格购买房屋。

Strike price 行使价

The strike price is the predetermined price at which you will have the right to buy (for call options) or sell (for put options) an underlying asset.

执行价格是您有权购买(对于看涨期权)或出售(对于看跌期权)标的资产的预定价格。

So when negotiating with the seller of the home, if you came to an agreed-upon number of $300,000 for the strike price, that is the price you would have to buy the home for if you decided to exercise the option. No matter what the current market price is, you would have the right to purchase the home at that fixed price as long as it is within the specified timeframe.

因此,在与房屋卖方谈判时,如果您达成了 300,000 美元的执行价格 ,那么如果您决定行使期权,这就是您必须购买房屋的价格。无论当前市场价格是多少,只要在指定的时间范围内,您都有权以该固定价格购买房屋。

The relationship between the strike price and the current market price of the underlying asset determines the value of an option contract.

行使价与标的资产的当前市场价格之间的关系决定了期权合约的价值。

Premium 奖赏

The premium is the price paid for an options contract. It is the cost of having the right but not the obligation to buy or sell an underlying asset.

溢价是为期权合约支付的价格。它是拥有购买或出售标的资产的权利但不是义务的成本。

Earlier, we compared this to a holding fee. Imagine that you pay the seller a $5,000 non-refundable holding fee to buy an option for the home. This premium ensures that you can buy the home for $300,000, regardless of the current market price, as long as it's within the predefined timeframe. If you decide not to buy, you lose the $5,000 premium.

早些时候,我们将其与持有费进行了比较 。想象一下,您向卖方支付了 5,000 美元的不可退还的持有费,以购买房屋的选择权。这笔溢价确保您可以以 300,000 美元的价格购买房屋,无论当前市场价格如何,只要它在预定义的时间范围内即可。如果您决定不购买,您将损失 5,000 美元的保费。

Some key components that can influence the price of the premium include:

可能影响溢价价格的一些关键因素包括:

The current market price for the underlying asset.

- 标的资产的当前市场价格。

The volatility of the underlying asset’s price.

- 标的资产价格的波动性。

The strike price. 执行价格。

The time until expiration.

- 到期前的时间。

Contract size 合约大小

Usually, an options contract for stocks covers 100 shares of the underlying asset. However, for other types of options, like those tied to indices or cryptocurrencies, the contract size can be different. That’s why it’s important to thoroughly check the contract details before trading, so you know exactly how much of the underlying asset you’re dealing with.

通常,股票期权合约涵盖 100 股标的资产。但是,对于其他类型的期权,例如与指数或加密货币挂钩的期权 ,合约规模可能会有所不同。这就是为什么在交易前彻底检查合约细节很重要的原因,这样您才能确切地知道您正在处理多少标的资产。

Important Terminology 重要术语

When dealing with options trading, there are some important concepts you should be familiar with.

在处理期权交易时,您应该熟悉一些重要的概念。

Profitability terms 盈利能力术语

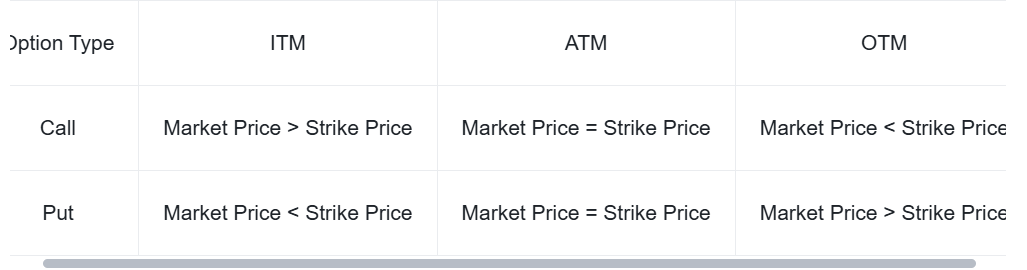

Terms like in the money (ITM), at the money (ATM), and out of the money (OTM) describe the relationship between the strike price and the current market price of the underlying asset. These terms are important because they not only inform whether you might want to exercise the option but, more importantly, how much the options contract itself is worth.

价内 (ITM)、 价内 (ATM) 和价外 (OTM) 等术语 描述了执行价格与标的资产的当前市场价格之间的关系。这些条款很重要,因为它们不仅告诉您是否要行使期权,更重要的是,它们告诉我们期权合约本身的价值。

The Greeks

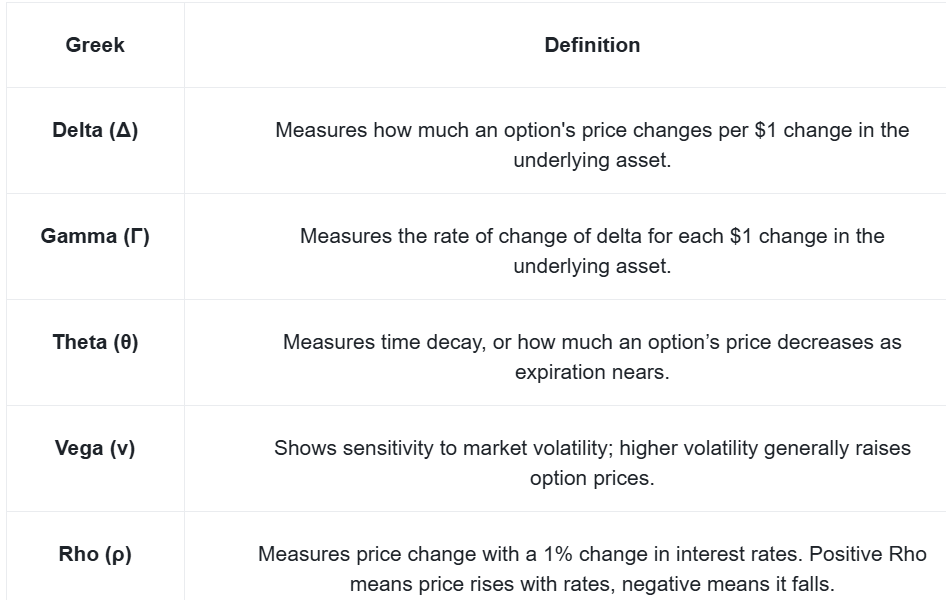

In options trading, the Greeks are risk measures that help traders understand how various factors affect an option’s price.

在期权交易中, 希腊字母是帮助交易者了解各种因素如何影响期权价格的风险指标。

Each Greek represents a different sensitivity, allowing traders to assess potential risks and make more informed decisions. The five key Greeks are Delta, Gamma, Theta, Vega, and Rho.

每个希腊希腊代表不同的敏感性,使交易者能够评估潜在风险并做出更明智的决策。五个关键的希腊字母是 Delta、Gamma、Theta、Vega 和 Rho。

American vs. European Options

美式期权 vs. 欧式期权

It is important to note that throughout this article, we have discussed options trading as it primarily exists in American markets, where American-style options are used. But depending on the market, you may also find European options. The key difference between these two types of options is when they can be exercised:

需要注意的是,在本文中,我们讨论了期权交易,因为它主要存在于使用美式期权的美国市场。但根据市场的不同,您可能还会找到欧洲的选择。这两种类型的期权之间的主要区别在于何时可以行使:

American options: can be exercised at any time before their expiration date, giving the holder more flexibility.

美式期权: 可以在到期日之前的任何时间行使,给持有人更大的灵活性。

European options: These options can only be exercised on their expiration date.

欧式期权: 这些期权只能在到期日行使。

Are Binance Options American or European?

Binance Options 是美国的还是欧洲的?

On the Binance trading platform, you will only find the European-style options. This means that when you trade options on Binance, you will only be able to exercise them on expiration. However, as most options trading involves buying and selling contracts rather than exercising them, this distinction mainly affects how and when the contract can be settled.

在 Binance 交易平台上, 您只会找到欧式选项 。这意味着当您在 Binance 上交易期权时,您只能在到期时行使它们。然而,由于大多数期权交易涉及买卖合约而不是行使合约,因此这种区别主要影响合约结算的方式和时间。

Options on Binance exercise automatically. This means that if your option is ITM when it expires, you will receive your pay-off regardless of whether you exercise the option yourself.

Binance 上的选项会自动行使。 这意味着,如果您的期权到期时是 ITM,无论您是否自己行使期权,您都将收到回报。

These option contracts are also cash-settled, meaning that when an option is exercised, instead of delivering the underlying asset, the parties exchange the cash value. This can simplify the process and avoid the complexities of asset delivery.

这些期权合约也是现金结算的,这意味着当期权被行使时,双方不会交付标的资产,而是交换现金价值。这可以简化流程并避免资产交付的复杂性。

Closing Thoughts 结束语

Options trading, particularly American-style options, gives traders and investors the choice to buy or sell an underlying asset at a fixed price before the expiration date. By removing immediate commitment from the equation, you can have more flexibility when engaging with financial markets.

期权交易,尤其是美式期权,让交易者和投资者可以选择在到期日之前以固定价格购买或出售标的资产。通过从等式中消除即时承诺,您可以在参与金融市场时拥有更大的灵活性 。

However, you can trade option contracts themselves without ever having to exercise them, allowing for profit from changes in the contract's value. While it offers profit potential, it is important to understand the key concepts behind options contracts before trading.

但是,您可以自己交易期权合约而无需行使它们,从而从合约价值的变化中获利。虽然它提供了盈利潜力,但在交易前了解期权合约背后的关键概念非常重要。

免责声明:本文内容按“原样”提供,仅作一般资讯及教育用途,不构成任何陈述或保证。本文不构成财务、法律或其他专业建议,且无意建议购买任何特定产品或服务。您应自行向合适的专业顾问寻求建议。如本文由第三方投稿,请注意本文观点属于第三方投稿人,所有内容仅用于知识普及,仅供参考,并可能随时进一步修改和更新。文章内容不应作为任何投资决策的凭证或依据,亦不应构成参与任何交易或采取任何投资策略的建议。

碧波摇篮|BiYiClub|抖音:BiYiClub|公众号:BiYiClub|点我加入交流社群学习

本文版权归 2025 Binance 经许可使用|作者:Binance|转载